Volatile mortgage rates are changing what some potential home buyers can afford from week to week, requiring a smarter way to shop

- Zillow’s new app filter allows shoppers to search for homes by a range of all-in monthly mortgage costs instead of list prices.

- Updated mortgage rates feed into the filter, meaning search results will stay within a shopper’s budget, regardless of how rates or prices move.

- Monthly mortgage costs rose by $431 over the past year, often swinging by more than $100 per month.

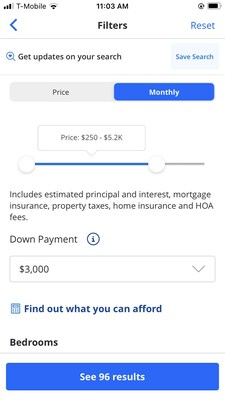

Zillow® has a new way to shop that helps buyers navigate a rapidly changing market and find homes that fit their monthly budget. The new filter shows homes within a range of all-in monthly costs, instead of list prices. This monthly cost includes principal and interest, as well as estimates for insurance costs, taxes and HOA fees, clarifying a chief source of confusion for buyers.

Shoppers can use the monthly payment filter now on the Zillow app.

Last year’s drastic rise in mortgage rates sent monthly costs for home buyers skyrocketing — nearly $700 more than the year before in recent months — and are now $431 higher than in March 20221. High rates combined with record-breaking home appreciation have nearly doubled monthly mortgage costs since 2020.

Rates are also extraordinarily volatile. Home prices nationwide started falling in June and flatlined this year, but shifting mortgage rates often swung costs by more than $100 month to month.

“Shoppers looking at list prices struggle to figure out what they can really afford, because the mortgage rate is what makes or breaks a monthly payment. Adding in costs like taxes, insurance and HOA fees can quickly bust a shopper’s budget,” said Amanda Pendleton, consumer finance expert at Zillow Home Loans. “This new search tool does the math, so shoppers can confidently jump into finding a home they love and can afford.”

Shoppers can start with Zillow’s linked affordability calculator, entering their down payment amount, income and debts to estimate the monthly mortgage cost they can afford. Then they enter their monthly budget range into the filter to start shopping. Updated mortgage rates feed into the filter, showing homes and hiding others to keep shoppers on budget as rates and price cuts change the monthly payment math.

A new survey from Zillow Home Loans finds that the most difficult financing activity among prospective home buyers is understanding all costs associated with a mortgage payment, followed by figuring out how much home they can afford, and researching mortgages and rates.

“Fast-rising mortgage rates last year pushed monthly costs up with unprecedented speed, dragging affordability to its lowest point in more than 20 years,” said Orphe Divounguy, senior macroeconomist at Zillow Home Loans. “Beyond the high costs, volatile mortgage rates have made it extremely difficult to plan and budget to buy a house.”

The new filter — coming soon to Zillow.com — is the latest Zillow technology helping buyers navigate a challenging affordability landscape. Down payment assistance that’s built into listings — letting shoppers see what’s available for them where they are looking — as well as mortgage and affordability calculators, can all help buyers make sense of the fast-moving market.

Although typical home values peaked in June before tapering off, mortgage rates that reached 20-year highs later in the year caused monthly mortgage payments to peak in October, Zillow data shows.

1 The monthly mortgage cost for a home priced at the Zillow Home Value Index for the United States, with a 5% down payment, at the average mortgage rate for that month and not including insurance and taxes.

About Zillow Group

Zillow Group, Inc. (NASDAQ: Z and ZG) is reimagining real estate to make it easier to unlock life’s next chapter. As the most visited real estate website in the United States, Zillow® and its affiliates offer customers an on-demand experience for selling, buying, renting, or financing with transparency and ease.

Zillow Group’s affiliates and subsidiaries include Zillow®; Zillow Premier Agent®; Zillow Home Loans™; Zillow Closing Services™; Trulia®; Out East®; StreetEasy®; HotPads®; and ShowingTime+™, which houses ShowingTime®, Bridge Interactive®, and dotloop®. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org).

(ZFIN)

SOURCE Zillow

For further information: Media contact: Mark Stayton, Zillow, press@zillow.com