AG Report Finds New Yorkers of Color Are Far Less Likely to Own a Home, More Likely to Be Denied Mortgages, and Face Higher Borrowing Costs

Disparities Cost Black and Latino Borrowers More Than $200 Million over the Course of Their Mortgages

NEW YORK – New York Attorney General Letitia James released a new report today detailing deep racial disparities in homeownership and access to home financing across the state. Among the report’s top findings is a stark racial gap in homeownership rates in every region in New York, with white households owning their homes at nearly double the rate of households of color. These disparities are a significant contributor to the racial wealth gap and result in higher housing costs for homebuyers of color, making it harder for communities of color to build lasting financial security and overcome decades of systemic discrimination in the housing market. The report also offers policy proposals to help close the homeownership gap.

“Owning a home is an essential part of achieving the American dream and building wealth to pass on to future generations,” said Attorney General James. “Unfortunately, unequal access to affordable credit is still pervasive across our state, reinforcing the legacy of segregation, leading to a disparity in homeownership, and fueling the racial wealth gap. This report makes it clear that our state must do more to provide better resources for homebuyers and strengthen housing laws to help empower more New Yorkers. My office remains committed to fighting housing discrimination in all forms, and I look forward to working with my partners in government to address this problem.”

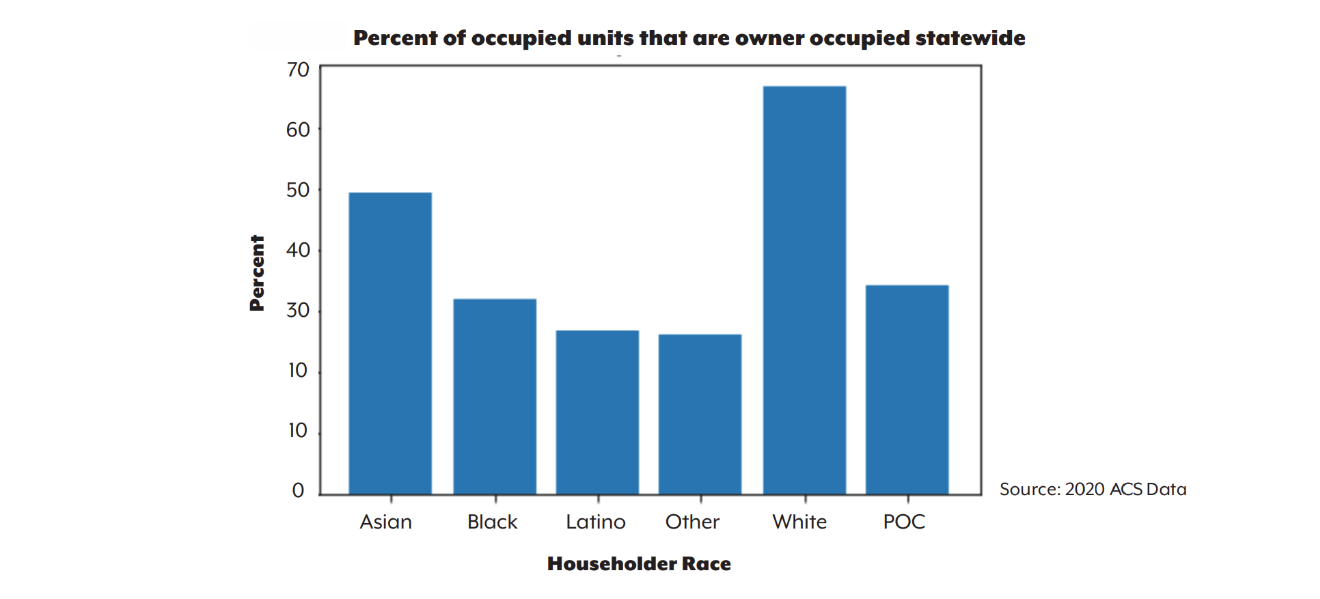

The Office of the Attorney General’s (OAG) report found that homeownership in New York is concentrated in white households and neighborhoods. This trend of lower homeownership rates for people of color is present throughout the state. The report noted that the city of Albany, the state’s capital, has the second-largest gap between white and Black homeownership of any city nationwide, second only to Minneapolis. Across New York, white households are 25 percent more likely than Asian households to own their home and more than twice as likely as Black or Latino households to own their home.

The report shows white households in New York are more than

twice as likely as Black or Latino households to own their home

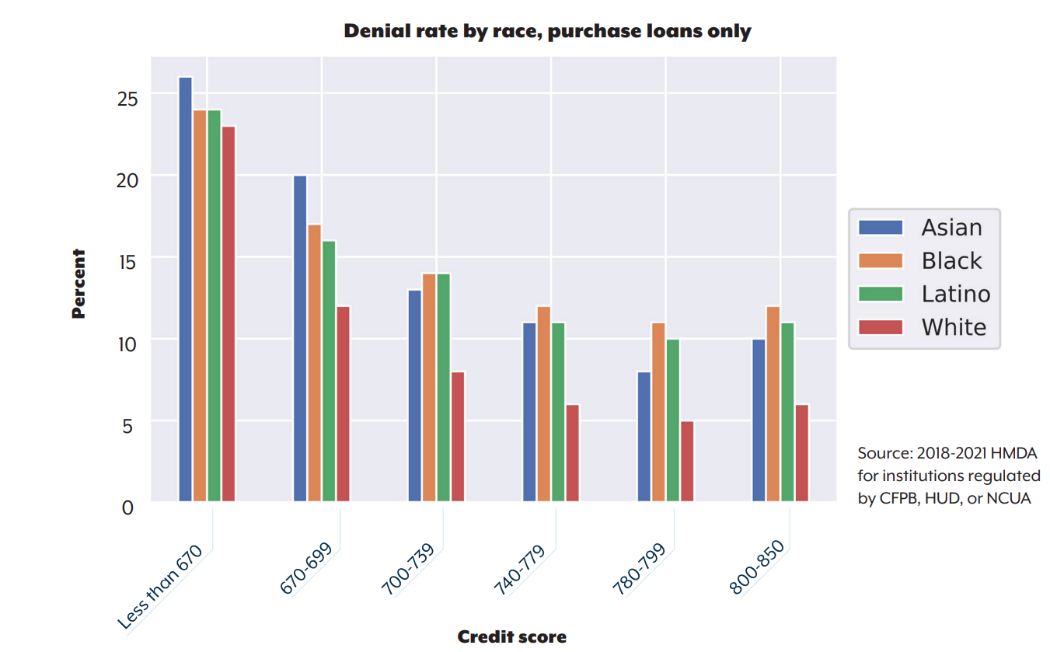

The report also reveals the significant barriers that borrowers of color face when attempting to purchase a home. Not only are Black and Latino New Yorkers disproportionately underrepresented among mortgage applicants, all applicants of color are denied mortgages at higher rates than white applicants, regardless of credit score, income, size of the loan, and other factors. Even among borrowers with the highest credit scores, non-white mortgage applicants are denied a mortgage at nearly double the rate of white applicants.

Across every credit score range, mortgage applicants

of color are denied at higher rates than white applicants

In addition, OAG’s report revealed that non-white prospective homebuyers face higher costs than their white counterparts. They are more likely to be charged higher interest rates for their loans, more likely to use costlier Federal Housing Administration loans, and less likely to be approved to refinance their loans to a lower rate. These added burdens total over $200 million more in interest and other costs over the course of Black and Latino borrowers’ loans.

The report identifies a number of state-level policy solutions that could help close the racial homeownership gap, including:

- Subsidizing down payments and interest rates for first-generation home buyers — who are disproportionately people of color — to make it easier for families who have never bought a home to get credit.

- Increasing state funding to nonprofit financial institutions that can better support communities of color underserved by traditional financial institutions.

- Passing the New York Public Banking Act to create a regulatory framework for cities, towns, and regions to establish public banks. These institutions would help expand access to affordable financial services in underserved communities.

- Increasing resources for government agencies’ fair lending investigations and strengthening New York’s Human Rights Law to expressly prohibit lending practices that have a disparate impact on communities of color.

- Exploring options for state-provided banking services at places like libraries and post offices to help reduce the population of New Yorkers who lack adequate access to traditional banking services.

“We laud the Attorney General for issuing this timely and important report, showing the persistence of systemic redlining and racial wealth extraction throughout New York,” said Deyanira Del Rio, Co-Director of New Economy Project. “Alongside our more than 50 partner organizations in the New York State Community Equity Agenda coalition, we call on New York to advance bold strategies that build community wealth and address racial wealth inequality head on. We agree with the Attorney General that enacting the New York Public Banking Act and fully funding the New York State CDFI Fund would be vital steps towards closing the racial wealth gap.”

“Even though the Fair Housing Act and the New York State Human Rights Law prohibit discrimination in home sales and mortgage lending, it still occurs at an alarming rate,” said M. DeAnna Eason, Executive Director of Housing Opportunities Made Equal, Inc. “The issues of systemic racism that plagued our communities decades ago remain today and pose significant barriers to families of color. This report from Attorney General James shines a light on a very serious wrong, so that we can continue to combat these prejudices.”

“This study reminds us of the devastating cost of redlining and the prevalence of systemic racism that continues to plague our society, which is as true in Rochester as it is in any part of our state,” said Simeon Banister, President and CEO of Rochester Area Community Foundation. “These data tell a bleak story, but they also strengthen our resolve to work alongside Attorney General James to close the racial wealth gap because if we do, all of our communities can truly thrive and prosper.”

“Fair housing laws have been on the books for more than half a century, yet lending discrimination and other barriers to homebuying unfortunately continue to deprive Black and Hispanic borrowers of the opportunity to escape ever-rising rents and the potential threat of eviction through the financial stability of homeownership,” said Sally Santangelo, Executive Director of CNY Fair Housing. “We thank Attorney General James for shining the spotlight on this persistent problem across New York state.”

“More than 50 years after the passage of the Fair Housing Act, it is shameful that systemic racial discrimination still exists in our housing market,” said Ian Wilder, Executive Director of Long Island Housing Services, Inc. “We are thankful to Attorney General James, as a high-profile elected official, for leading the way in educating the public on how far we still have to go for the American Dream to be equally available to everyone. It is a good start that symbols of hate have been torn down in other parts of the country, but that is insufficient. Business and government in New York must come together to take responsibility for creating these abusive conditions and make significant changes in how they operate to remedy this injustice.”

“The Attorney General’s report isn’t just numbers — it’s a testament to the enduring economic chains binding Black and Latino New Yorkers,” said Dan Lloyd, Founder of Minority Millennials. “A $200 million disparity isn’t a mere gap: it’s a generational theft. We must rewrite this narrative.”

“Communities of color historically face multiple barriers to homeownership such as limited access to financing by banks which leads to higher borrowing costs,” said Thomas Yu, Executive Director of Asian Americans For Equality. “These historical disparities can make the prospect of owning a home seemingly insurmountable, and we thank Attorney General James for this deep dive into the data so that we may begin to undo generations of harm to communities of color throughout the state of New York.”

“The Attorney General’s report goes to the heart of racial disparities in mortgage lending that have caused decades of harm to New Yorker’s Black and Latino communities and prevented wealth and asset accumulation to these individuals and their families,” said Melissa Marquez, CEO of the Genesee Co-op FCU. “It is long past time to implement the report’s creative policy recommendations — and to begin to change the deeply entrenched racial wealth gap that continues to exist.”

“Home HeadQuarters applauds New York Attorney General Letitia James for shining a much-needed light on racial disparities in homeownership and home financing across the state,” said Kerry Quaglia, CEO of Home HeadQuarters. “These racial disparities, or lack of equitable access to credit and quality housing for families of color, is the reason Home HeadQuarters was created almost three decades ago and is also why currently, every nine out of 10 new home purchases by families of color in Onondaga County is financed through our organization.”

“Access to equitable credit is a significant contributor to the stark racial gap in homeownership rates that we see today for the communities we serve — the majority of which are Black and Brown. As homeownership advocates who approach our mission from a variety of angles, we work tirelessly to close this gap.” said Christie Peale, CEO and Executive Director of Center for NYC Neighborhoods. “We applaud Attorney General James for spotlighting this issue and highlighting local avenues for advocacy work going forward. We look forward to helping realize and expand this equitable access to credit through our CDFI and programming.”

“Attorney General Letitia James’ report on the racially based disparities in homeownership shines a bright light on discrimination in housing and mortgage lending in New York state,” said Kirsten Keefe, Senior Staff Attorney and Director of HOPP Anchor Partner Program, Empire Justice Center. “The findings reflect what homeowner advocates have seen for years. Homeownership continues to be the most critical tool for building generational wealth for most people, and we hope the report will lead to systemic changes in our state.”

“The Attorney General’s Homeownership report is alarming and clearly illustrates that we have long way to go to ensure that communities of color have equitable opportunities to own a home,” said Frankie Miranda, President and CEO of Hispanic Federation. “Homeownership is a crucial way for to families build generational wealth, and it’s unacceptable that Black and Latino New Yorkers continue to face higher costs and interest rates that shut them out of the real-estate market. It’s past due for the state, federal, and private sectors to come together and begin breaking down these barriers so that all New Yorkers, regardless of their race or zip code, have an opportunity to own a home.”

“It is disheartening to read New York Attorney General Letitia James’ report detailing that hard working, credit worthy, savings-minded Black and Latino New Yorkers remain less likely to own a home, more likely to be denied mortgages, and charged higher interest rates for a loan,” said Ronald Rosado Abad, CEO of Community Housing Innovations. “Homeownership is the basis for wealth creation and upward mobility. Community Housing Innovations, a major nonprofit leader in the affordable housing and homeownership industry in New York, supports and advocates for increased access to homeownership financing for all New Yorkers.”

“We thank Attorney General James and her team for doing this work and sharing it with us,” said Tanya Dwyer, Legal Services of the Hudson Valley. “The numbers in this report reflect the disparities and effects of systemic discrimination that we see in our work with clients. As a Homeowner Protection Program Network member, we will continue to fight alongside the Attorney General’s Office to protect homeowners from such discrimination.”

The OAG’s report was prepared by Jasmine McAllister, Gautam Sisodia, and Blake Rubey of OAG’s Research and Analytics Department, Megan Thorsfeldt and Jonathan Werberg formerly of the Research and Analytics Department, Mark Ladov of the Consumer Frauds Bureau, and Lindsay McKenzie and Joel Marrero of the Civil Rights Bureau. The Consumer Frauds Bureau is a part of the Division for Economic Justice, which is led by Chief Deputy Attorney General Chris D’Angelo. The Civil Rights Bureau is a part of the Division for Social Justice, which is led by Chief Deputy Attorney General Meghan Faux. Both the Division for Economic Justice and the Division for Social Justice are overseen by First Deputy Attorney General Jennifer Levy.