MCLEAN, Va., Nov. 01, 2018 (GLOBE NEWSWIRE) — Freddie Mac (OTCQB:FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing rates dropping slightly after last week’s increases.

| |||||

Sam Khater, Freddie Mac’s chief economist, says, “While higher mortgage rates have led to a decline in home sales this year, the weakness has been concentrated in expensive segments versus entry-level and first-time buyer which remains firm throughout most of the rest of the country. Despite higher mortgage rates, the monthly mortgage payment remains affordable. For many buyers the chronic lack of entry-level supply is a larger hurdle than higher mortgage rates because choices are limited and the inventory shortage has caused home prices to rise well above fundamentals.”

News Facts

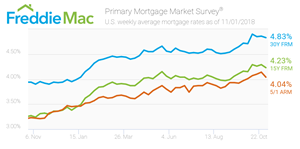

- 30-year fixed-rate mortgage (FRM) averaged 4.83 percent with an average 0.5 point for the week ending November 1, 2018, down from last week when it averaged 4.86 percent. A year ago at this time, the 30-year FRM averaged 3.94 percent.

- 15-year FRM this week averaged 4.23 percent with an average 0.5 point, down from last week when it averaged 4.29 percent. A year ago at this time, the 15-year FRM averaged 3.27 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.04 percent with an average 0.3 point, down from last week when it averaged 4.14 percent. A year ago at this time, the 5-year ARM averaged 3.23 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Freddie Mac makes home possible for millions of families and individuals by providing mortgage capital to lenders. Since our creation by Congress in 1970, we’ve made housing more accessible and affordable for homebuyers and renters in communities nationwide. We are building a better housing finance system for homebuyers, renters, lenders, investors and taxpayers. Learn more at FreddieMac.com, Twitter @FreddieMac and Freddie Mac’s blog FreddieMac.com/blog.

MEDIA CONTACTS: Chad Wandler

703-903-2446

Nicole Flores

703-903-4068

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/e87d5e53-956a-47ba-aee1-6a6a95e9b53a

Source: Freddie Mac

This article appears in: News Headlines

Referenced Stocks: FMCC