- During the first two years of the pandemic, the typical rent increased 18% nationwide while the value of housing vouchers rose by only 7%.

- With more than 19 million voucher-eligible households in 2021 but fewer than 2 million vouchers available across the country’s metro areas, the program needs to be improved and better funded to help more low-income households.

Housing Choice Vouchers are failing to keep up with rising rents, exposing rent-burdened households to economic uncertainty or homelessness. This is according to Zillow’s latest research, which found nearly 10 times more qualified voucher recipients than vouchers in most large U.S. metros. The analysis also found voucher values grew at less than half the pace of typical rent during the pandemic.

“Renters across the country are struggling as costs have skyrocketed and vouchers have failed to keep up,” said Orphe Divounguy, senior economist at Zillow. “Better calculating for voucher values and more funding are good short-term solutions, but building more homes is the long-term answer.”

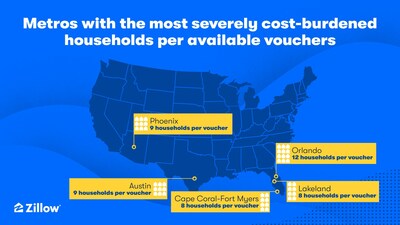

Zillow research found there was not a single large metro area with enough vouchers to meet demand. Across the country, there were nearly 10 times as many eligible voucher recipients as there were vouchers. In addition, there were nearly four times more severely cost-burdened households than voucher recipients.

Several metros in Florida stand out for their extreme mismatches between vouchers and those who need them. Orlando had the highest mismatch in the nation, with 12 severely cost-burdened households for every available voucher.

Between February 2020 and February 2022, the typical U.S. rent grew by an astonishing 18%, but voucher values grew by only 7%. Counties with the biggest disparity between rent growth and voucher values were scattered throughout the country, but Florida — a state that experienced among the fastest rent increases in the country — stood out again with several counties suffering the largest gaps. In Miami–Dade County, rent growth outpaced voucher values by almost 50 percentage points in those two years.

County | Percentage by which rent |

Miami–Dade County, Florida | 47.8 % |

Lee County, Florida | 46.5 % |

Palm Beach County, Florida | 38.9 % |

Broward County, Florida | 37.7 % |

Ocean County, New Jersey | 33.8 % |

Pinellas County, Florida | 28.2 % |

Collin County, Texas | 26.0 % |

Marion County, Indiana | 25.6 % |

King County, Washington | 25.3 % |

Hillsborough County, Florida | 24.8 % |

How vouchers work

The Housing Choice Voucher Program is a critical rental assistance program provided by the U.S. Department of Housing and Urban Development (HUD), and is sometimes referred to as Section 8. The program pays landlords a portion of the rent directly on behalf of the tenant, and the tenant pays the difference.

Eligibility for a housing voucher is based on income and family size. In general, a family’s income may not exceed 50% of the median income for the county or metropolitan area in which the family chooses to live. Typically, a voucher holder pays about 30% of their income as rent and the program pays the rest, up to a ceiling determined by HUD as the fair market value.

Recent Zillow research found that it would take four full-time minimum wage workers to reasonably afford a two-bedroom rental, illustrating the daunting financial challenges many renters face today. With voucher values eroding, voucher holders will have fewer options for places to rent and will likely be forced farther away from neighborhoods with amenities and job centers. The increase in rents leaves many rent-burdened families exposed to eviction, health crises and homelessness.

What can be done

As part of National Fair Housing Month, Zillow is highlighting several policy solutions that could improve this program.

Zillow is working with HUD to help improve the formula used to calculate fair market rent values. By incorporating the Zillow Observed Rent Index (ZORI), HUD’s fair market rents should become more responsive to rent increases. Most critically, without an increase in funding, fewer vouchers could leave many rent-burdened voucher-eligible families behind.

Increasing landlord participation can also help keep people housed. Lawmakers could pass source-of-income protections to ensure all housing providers participate in the program. Additionally, policymakers should find ways to shore up housing provider education and outreach, and to streamline and modernize programs so that landlords feel more confident navigating this program successfully.

These are short-run policy solutions. Creating more homes is the longer-term solution to making housing more affordable. A recent Zillow survey of housing experts and economists found broad agreement that loosening zoning laws would be the most effective path to achieving this outcome.

“I applaud Zillow for shining a 100-megawatt spotlight on the immense rental affordability challenges facing millions of low-income families across the United States,” said Dennis Shea, executive director of the J. Ronald Terwilliger Center for Housing Policy. “This critical research challenges policymakers to take immediate action. Strengthening the Housing Choice Voucher program, encouraging greater landlord participation in the program by enacting the Choice in Affordable Housing Act, and increasing the supply of affordable rental homes by passing the Affordable Housing Credit Improvement Act should all be on Congress’s must-do list.”

About Zillow Group

Zillow Group, Inc. (NASDAQ: Z and ZG) is reimagining real estate to make it easier to unlock life’s next chapter. As the most visited real estate website in the United States, Zillow® and its affiliates offer customers an on-demand experience for selling, buying, renting, or financing with transparency and ease.

Zillow Group’s affiliates and subsidiaries include Zillow®; Zillow Premier Agent®; Zillow Home Loans™; Zillow Closing Services™; Trulia®; Out East®; StreetEasy®; HotPads®; and ShowingTime+℠ , which houses ShowingTime®, Bridge Interactive®, and dotloop® and interactive floor plans. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org).

SOURCE Zillow

For further information: Will Lemke, Zillow, press@zillow.com