– Quicken Loans’ National HPPI shows appraised values 0.49% lower than homeowners estimated in September

– Home values rose 2.15% nationally in September, and posted a 6.52% year-over-year increase, according to the Quicken Loans HVI

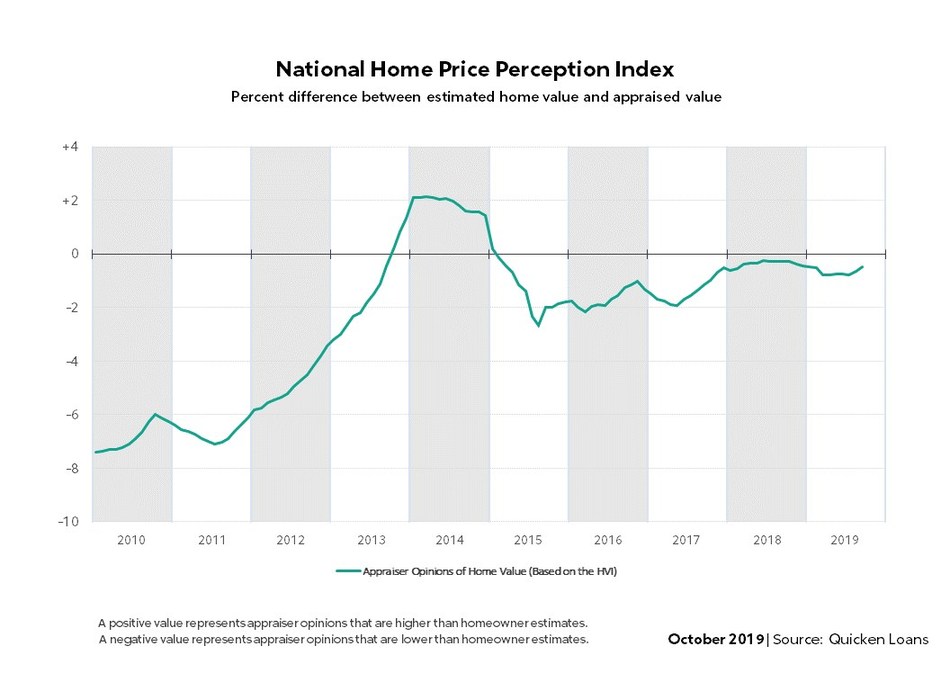

Homeowners are moving closer to understanding their home’s true value, according the Quicken Loans National Home Price Perception Index (HPPI). The report showed that the average home appraisal in September was just 0.49% lower than what homeowners expected. This is positive movement toward equilibrium between owners’ estimates and appraisers’ opinions, considering the data from August showed appraisals 0.64% less than what was expected.

Many of the nation’s largest metro areas mirrored the positive national trend, as the average appraisal was higher than expected in 55% of the metro areas studied. Conversely, all metros with average appraisals lower than the homeowners’ estimate had a less than 2% gap between the expectation and the actual appraised value. Boston and Charlotte had the largest spread, showing homeowners underestimated their value, with average appraisals 1.71% and 1.61% higher than owner estimates. Chicago remains the city whose homeowners overestimated their homes’ value the most, albeit by only 1.67%.

“The HPPI is a reminder to have a good grasp on your area’s unique housing market before you start the mortgage process, for either a home purchase or a refinance,” said Bill Banfield, Executive Vice President of Capital Markets for Quicken Loans. “Underestimating your home value could, understandably, feel like a windfall. But if a homeowner overestimates their home value, the mortgage could need to be reworked when refinancing – possibly even requiring the owner to bring more cash to the closing table.”

The banner news from September is the leap in home values. The average appraisal in the month was 2.15% higher than in August, according to the Quicken Loans Home Value Index (HVI). This is the largest monthly increase in more than five years. The annual growth in September was even more impressive, increasing 6.52% year-over-year. That is nearly two percentage points higher than the annual growth reported in August.

The large increase in home values at a national level was achieved thanks to positive movement in every region of the country, on both a monthly and annual basis. The South had the most modest home appraisal growth, in both the monthly and annual measures, with a 0.26% monthly increase and 4.28% growth year-over-year. The West boasted the largest monthly jump of 2.93%, but the Midwest achieved the largest annual improvement – reporting a 6.34% increase in average appraised value.

“The clear news from the HPPI data is that homebuyer interest is not falling with the leaves,” said Banfield. “Despite the start of the school year, and the introduction of cooler temperatures in parts of the country, home shoppers are still active. Buyer interest, combined with persistently low home inventory, continues to drag up home values. With August’s jump in homebuilding, at its highest level in 12 years there could be some hope on horizon for home shoppers who haven’t been able to find a home that is a perfect fit at the right price.”

|

HVI September 2019 January 2005 = |

HVI September 2019 vs. August 2019 % Change |

HVI September 2019 vs. September 2018 % Change |

HPPI September 2019 Appraiser Value |

HPPI September 2018 Appraiser Value |

|

|

National |

117.58 |

+2.15% |

+6.52% |

-0.49% |

-0.29% |

*A positive value represents appraiser opinions that are higher than homeowner perceptions. A negative value represents appraiser opinions that are lower than homeowner perceptions.

|

Geographic Regions |

HVI September 2019 January 2005 = |

HVI September 2019 vs. August 2019 % Change |

HVI September 2019 vs. September 2018 % Change |

HPPI September 2019 Appraiser Value |

HPPI September 2018 Appraiser Value |

|

West |

143.75 |

+2.93% |

+5.51% |

-0.45% |

-0.12% |

|

Northeast |

107.49 |

+1.53% |

+4.52% |

-0.50% |

-0.38% |

|

Midwest |

96.46 |

+1.52% |

+6.34% |

-0.51% |

-0.35% |

|

South |

116.08 |

+0.26% |

+4.28% |

-0.51% |

-0.31% |

*A positive value represents appraiser opinions that are higher than homeowner perceptions. A negative value represents appraiser opinions that are lower than homeowner perceptions.

|

Metropolitan Areas |

HPPI September 2019 Appraiser Value |

HPPI August 2019 Appraiser Value |

HPPI September 2018 Appraiser Value |

|

Boston, MA |

+1.71% |

+2.05% |

+2.95% |

|

Charlotte, NC |

+1.61% |

+1.80% |

+2.03% |

|

Minneapolis, MN |

+1.07% |

+1.35% |

+2.04% |

|

Denver, CO |

+0.94% |

+1.27% |

+2.64% |

|

San Jose, CA |

+0.90% |

+1.19% |

+2.39% |

|

Seattle, WA |

+0.72% |

+0.93% |

+2.38% |

|

Atlanta, GA |

+0.71% |

+0.85% |

+0.83% |

|

Las Vegas, NV |

+0.57% |

+0.74% |

+1.58% |

|

San Francisco, CA |

+0.55% |

+0.56% |

+1.82% |

|

Dallas, TX |

+0.36% |

+0.78% |

+1.65% |

|

Washington, D.C. |

+0.26% |

+0.25% |

+0.80% |

|

Phoenix, AZ |

+0.18% |

+0.26% |

+0.58% |

|

San Diego, CA |

+0.06% |

+0.28% |

+0.91% |

|

Portland, OR |

+0.04% |

+0.10% |

+1.22% |

|

Kansas City, MO |

+0.02% |

+0.08% |

+0.93% |

|

Sacramento, CA |

-0.03% |

+0.08% |

+0.66% |

|

Los Angeles, CA |

-0.19% |

-0.15% |

+0.48% |

|

New York, NY |

-0.21% |

-0.40% |

+0.42% |

|

Riverside, CA |

-0.46% |

-0.31% |

+0.83% |

|

Miami, FL |

-0.47% |

-0.65% |

+0.17% |

|

Houston, TX |

-0.66% |

-0.71% |

-0.73% |

|

Tampa, FL |

-0.71% |

-0.61% |

-0.64% |

|

Baltimore, MD |

-0.74% |

-0.94% |

-1.38% |

|

Detroit, MI |

-0.94% |

-0.96% |

+0.16% |

|

Cleveland, OH |

-1.27% |

-1.50% |

-1.00% |

|

Philadelphia, PA |

-1.37% |

-1.42% |

-0.90% |

|

Chicago, IL |

-1.67% |

-1.77% |

-1.95% |

*A positive value represents appraiser opinions that are higher than homeowner perceptions. A negative value represents appraiser opinions that are lower than homeowner perceptions.

About the HPPI & HVI

The Quicken Loans HPPI represents the difference between appraisers’ and homeowners’ opinions of home values. The index compares the estimate that the homeowner supplies on a refinance mortgage application to the appraisal that is performed later in the mortgage process. This is an unprecedented report that gives a never-before-seen analysis of how homeowners are viewing the housing market. The HPPI national composite is determined by analyzing appraisal and homeowner estimates throughout the entire country, including data points from both inside and outside the metro areas specifically called out in the above report.

The Quicken Loans HVI is the only view of home value trends based solely on appraisal data from home purchases and mortgage refinances. This produces a wide data set and is focused on appraisals, one of the most important pieces of information to the mortgage process.

The HPPI and HVI are released on the second Tuesday of every month. Both of the reports are created with Quicken Loans’ propriety mortgage data from the 50-state lenders’ mortgage activity across all 3,000+ counties. The indexes are examined nationally, in four geographic regions and the HPPI is reported for 27 major metropolitan areas. All indexes, along with downloadable tables and graphs can be found at QuickenLoans.com/Indexes.

About Quicken Loans

Detroit-based Quicken Loans Inc. is the nation’s largest home mortgage lender. The company closed nearly half a trillion dollars of mortgage volume across all 50 states from 2013 through 2018. Quicken Loans moved its headquarters to downtown Detroit in 2010. Today, Quicken Loans and its Family of Companies employ more than 17,000 full-time team members in Detroit’s urban core. The company generates loan production from web centers located in Detroit, Cleveland and Phoenix. Quicken Loans also operates a centralized loan processing facility in Detroit, as well as its San Diego-based One Reverse Mortgage unit. Quicken Loans ranked highest in the country for customer satisfaction for primary mortgage origination by J.D. Power for the past nine consecutive years, 2010 – 2018, and also ranked highest in the country for customer satisfaction among all mortgage servicers the past six consecutive years, 2014 – 2019.

Quicken Loans was once again named to FORTUNE magazine’s “100 Best Companies to Work For” list in 2019 and has been included in the magazine’s top 1/3rd of companies named to the list for the past 16 consecutive years. In addition, Essence Magazine named Quicken Loans “#1 Place to Work in the Country for African Americans.”

For more information and company news visit QuickenLoans.com/press-room.

SOURCE Quicken Loans