A new, slower equilibrium may be settling in after years of imbalance

- High mortgage rates stifled sales, now down 24% year over year and 17% from October 2019

- Rates are also stymieing sellers. New listings dropped by more than 12% since September.

- Typical rent in the U.S. fell for the first time in two years.

Buyers and sellers are both stepping away as skyrocketing mortgage rates have settled the housing market into a more balanced state, according to the latest Zillow® market report1. Home values remained nearly flat in October as new inventory waned and sales continued to fall from the pandemic frenzy.

“Home prices in October remained in suspended animation as more buyers, but especially sellers, took a wait-and-see approach to market conditions,” said Skylar Olsen, chief economist at Zillow. “Fewer home sales is the hallmark of a housing market lull, but right now potential sellers sensitive to losing their historically low mortgage rates have as much, if not more, of a reason to wait for a robust spring season and hope for mortgage rate relief. With some renewed competition, buyers hoping for aggressive price declines may be disappointed in all but the frothiest pandemic-era markets.”

Rapidly rising mortgage rates coupled with stubbornly high home prices are driving drastic drops in affordability. The share of income spent on monthly mortgage payments has risen from 27.7% in February to 37.3% in October — well above a previous peak of 35% in 2006. Housing payments are considered to be a financial burden when they exceed 30% of a household’s income.

The monthly mortgage payment on the purchase of a typical house in the U.S., even when putting 20% down, was $1,910 in October. That’s a 77% jump year over year and a 107% increase — nearly $1,000 — from 2019. Monthly payment figures are even higher when including taxes and insurance and when putting less than 20% down, as more than half of borrowers do.

Affordability challenges are weighing heavily on sales. Sales counts, nowcast for the most recent month due to latency, show significant slowing in recent months and standing 16% to 17% below pre-pandemic October norms.

While it’s tempting to focus on buyers, mortgage-rate-driven affordability changes are highly impactful on seller behavior, keeping more existing homes out of the market. While first-time buyers have experienced continued pressure on rent as well, homeowners who bought or refinanced when rates were near record lows in 2020 and 2021 are sitting on substantial home value gains and have little incentive to take out a new home loan, deciding instead to enjoy their current monthly payment.

To that point, the number of new for-sale listings dropped by more than 12% month over month, bringing the flow of listings to the market 24% lower than in 2021 and 21% below 2019. The steepest drops in new listings from September came in Seattle (-28.5%), Denver (-26%) and Washington, D.C. (-24.2%). New inventory increased month over month in two major metros — Jacksonville (3.1%) and Tampa (1.3%) — while the smallest declines took place in other Florida cities and across relatively affordable metros in the Midwest.

The drastic pullback of new listings has stalled out the recovery in total inventory that began in March. There are slightly more (1.8%) for-sale listings on Zillow than a year ago, but still far fewer (-36.1%) than in October 2019.

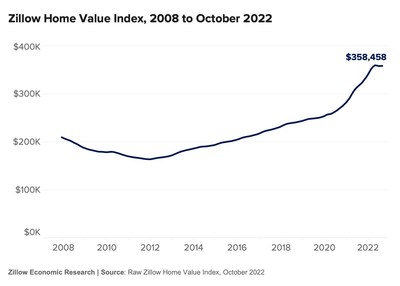

With both supply and demand drying up, U.S. home values held steady, rising 0.1% since September, marking the fourth consecutive month of muted movement. Typical home values are $358,458, up nearly 12% over 2021 and 43% higher than before the pandemic. Major metros with the largest home value appreciation since 2019 are Tampa (72%), Austin (64%), Jacksonville (62%) and Phoenix (60%).

Some expensive Western markets, including Los Angeles (+0.8%) and Riverside (+0.4%), abruptly snapped steep value-losing streaks; time will tell if September marked the bottom for price declines in these cities. Las Vegas (-2.3%) and Austin (-2.2%) saw the sharpest home value declines among major metro areas.

The Zillow Observed Rent Index showed a slight 0.1% decrease from September to October, ending a two-year streak in rent growth. The decline is a small step toward normalcy, harking back to October declines seen from 2017 through 2020. Typical U.S. rent is now $2,040, up 9.6% since last October and nearly 27% since 2019.

Metropolitan | October | October | Monthly | Monthly | New For- | Zillow | Zillow |

United States | $358,458 | 11.9 % | $1,910 | 77.0 % | -12.8 % | $2,040 | 9.6 % |

New York, NY | $618,741 | 7.9 % | $3,303 | 69.7 % | -21.7% | $3,212 | 13.2 % |

Los Angeles, CA | $904,367 | 5.4 % | $4,826 | 66.5 % | -15.2% | $2,979 | 8.9 % |

Chicago, IL | $312,194 | 8.2 % | $1,663 | 70.8 % | -8.5% | $1,869 | 8.7 % |

Dallas–Fort Worth, TX | $391,640 | 16.1 % | $2,082 | 84.3 % | -15.9% | $1,855 | 9.8 % |

Philadelphia, PA | $341,929 | 9.8 % | $1,813 | 71.5 % | -7.2% | $1,793 | 6.8 % |

Houston, TX | $315,089 | 13.0 % | $1,678 | 78.8 % | -13.4% | $1,613 | 5.8 % |

Washington, DC | $552,639 | 6.0 % | $2,939 | 65.9 % | -9.9% | $2,257 | 6.5 % |

Miami–Fort Lauderdale, FL | $473,630 | 23.3 % | $2,526 | 96.8 % | -13.6% | $2,827 | 16.4 % |

Atlanta, GA | $380,542 | 14.2 % | $2,038 | 84.6 % | -12.9% | $2,002 | 7.2 % |

Boston, MA | $646,045 | 6.9 % | $3,457 | 69.0 % | -4.0% | $2,806 | 10.1 % |

San Francisco, CA | $1,369,586 | 1.9 % | $7,340 | 61.2 % | -7.4% | $3,199 | 5.8 % |

Detroit, MI | $239,563 | 6.9 % | $1,276 | 68.2 % | -7.3% | $1,460 | 7.5 % |

Riverside, CA | $571,380 | 8.3 % | $3,052 | 72.1 % | -14.5% | $2,584 | 7.1 % |

Phoenix, AZ | $449,590 | 6.4 % | $2,418 | 70.7 % | -9.3% | $1,938 | 4.8 % |

Seattle, WA | $757,177 | 7.9 % | $4,042 | 71.5 % | -16.5% | $2,285 | 6.8 % |

Minneapolis–St. Paul, MN | $371,658 | 5.6 % | $1,979 | 65.7 % | -13.8% | $1,632 | 4.3 % |

San Diego, CA | $876,288 | 7.6 % | $4,711 | 71.3 % | -16.3% | $3,105 | 12.8 % |

St. Louis, MO | $246,368 | 10.1 % | $1,308 | 72.0 % | -5.6% | $1,273 | 9.8 % |

Tampa, FL | $391,409 | 21.2 % | $2,090 | 94.0 % | -13.8% | $2,135 | 9.8 % |

Baltimore, MD | $378,548 | 7.6 % | $2,014 | 68.4 % | -7.4% | $1,798 | 4.1 % |

Denver, CO | $621,003 | 8.0 % | $3,319 | 71.8 % | -16.3% | $2,028 | 6.3 % |

Pittsburgh, PA | $209,221 | 3.4 % | $1,117 | 62.4 % | -6.0% | $1,338 | 6.6 % |

Portland, OR | $562,754 | 5.4 % | $3,008 | 66.5 % | -15.0% | $1,949 | 7.6 % |

Charlotte, NC | $386,769 | 16.4 % | $2,072 | 86.9 % | -16.1% | $1,824 | 10.4 % |

Sacramento, CA | $590,167 | 4.4 % | $3,153 | 64.3 % | -14.5% | $2,326 | 4.9 % |

San Antonio, TX | $339,669 | 12.9 % | $1,818 | 80.2 % | -14/.8% | $1,518 | 6.0 % |

Orlando, FL | $402,170 | 20.9 % | $2,148 | 94.0 % | -14.3% | $2,045 | 11.7 % |

Cincinnati, OH | $265,208 | 10.2 % | $1,412 | 73.3 % | -5.9% | $1,505 | 11.5 % |

Cleveland, OH | $219,237 | 9.7 % | $1,171 | 72.3 % | -5.3% | $1,370 | 8.8 % |

Kansas City, MO | $291,747 | 10.4 % | $1,548 | 73.6 % | -6.8% | $1,364 | 11.0 % |

Las Vegas, NV | $422,503 | 8.3 % | $2,304 | 77.6 % | -14.7% | $1,832 | 1.6 % |

Columbus, OH | $302,536 | 10.7 % | $1,622 | 76.4 % | -3.9% | $1,509 | 9.0 % |

Indianapolis, IN | $275,638 | 14.0 % | $1,466 | 80.9 % | -9.3% | $1,483 | 10.4 % |

San Jose, CA | $1,568,484 | 6.2 % | $8,287 | 65.8 % | -11.7% | $3,341 | 8.3 % |

Austin, TX | $541,125 | 2.3 % | $2,934 | 65.8 % | -21.6% | $1,912 | 6.0 % |

Virginia Beach, VA | $335,691 | 10.6 % | $1,786 | 73.7 % | -17.3% | $1,648 | 5.3 % |

Nashville, TN | $451,005 | 17.5 % | $2,420 | 90.2 % | -19.9% | $1,906 | 9.5 % |

Providence, RI | $449,220 | 8.4 % | $2,398 | 71.2 % | -13.3% | $1,986 | 10.1 % |

Milwaukee, WI | $271,085 | 8.5 % | $1,436 | 68.5 % | -1.0% | $1,243 | 6.8 % |

Jacksonville, FL | $378,695 | 19.8 % | $2,024 | 92.4 % | -31.2% | $1,810 | 8.3 % |

Memphis, TN | $236,600 | 13.2 % | $1,261 | 80.4 % | -15.9% | $1,501 | 7.6 % |

Oklahoma City, OK | $223,762 | 13.5 % | $1,188 | 78.5 % | -7.5% | $1,316 | 6.4 % |

Louisville, KY | $244,522 | 9.2 % | $1,302 | 72.4 % | -11.5% | $1,293 | 11.5 % |

Hartford, CT | $324,546 | 10.3 % | $1,724 | 72.2 % | -6.2% | $1,707 | 9.1 % |

Richmond, VA | $344,784 | 11.9 % | $1,834 | 75.5 % | -7.0% | $1,613 | 10.5 % |

New Orleans, LA | $269,678 | 7.8 % | $1,442 | 70.6 % | -9.0% | $1,527 | 6.8 % |

Buffalo, NY | $244,383 | 8.1 % | $1,303 | 69.9 % | -11.4% | $1,255 | 8.3 % |

Raleigh, NC | $445,853 | 13.7 % | $2,396 | 84.5 % | -22.2% | $1,793 | 9.5 % |

Birmingham, AL | $250,650 | 11.9 % | $1,335 | 76.6 % | -12.9% | $1,326 | 7.7 % |

Salt Lake City, UT | $583,074 | 6.1 % | $3,110 | 69.0 % | -11.3% | $1,764 | 10.6 % |

*Table ordered by market size

1 The Zillow Real Estate Market Report is a monthly overview of the national and local real estate markets. The reports are compiled by Zillow Research. For more information, visit www.zillow.com/research.

About Zillow Group

Zillow Group, Inc. (NASDAQ: Z and ZG) is reimagining real estate to make it easier to unlock life’s next chapter. As the most visited real estate website in the United States, Zillow® and its affiliates offer customers an on-demand experience for selling, buying, renting, or financing with transparency and ease.

Zillow Group’s affiliates and subsidiaries include Zillow®; Zillow Premier Agent®; Zillow Home Loans™; Zillow Closing Services™; Trulia®; Out East®; StreetEasy®; HotPads®; and ShowingTime+™, which houses ShowingTime®, Bridge Interactive®, and dotloop®. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org).

SOURCE Zillow