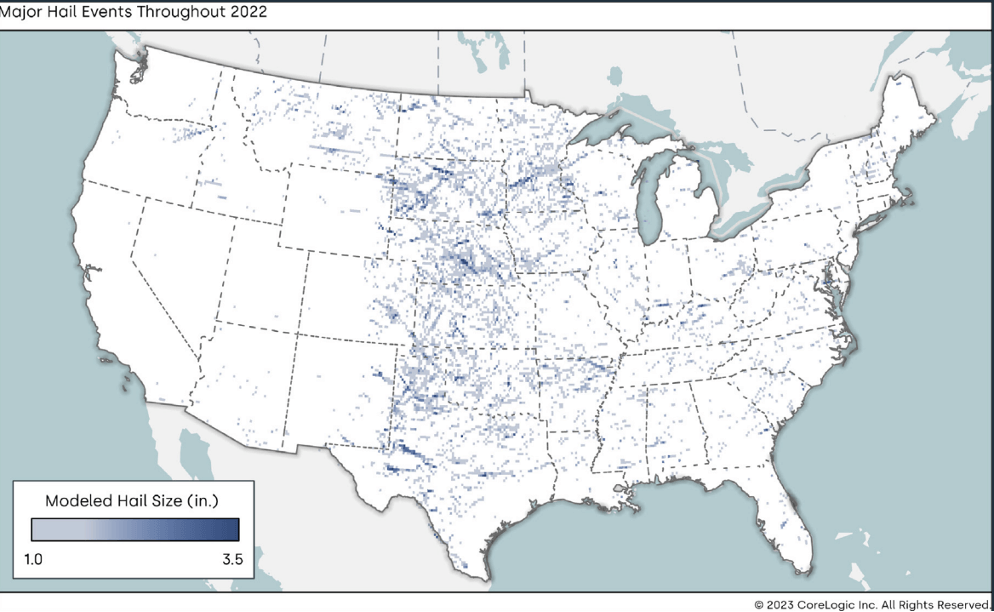

Texas, Missouri, Minnesota, Colorado and Oklahoma have the most homes at risk of impact from hailstorms

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, released its 2023 Severe Convective Storm Risk Report, which analyzes the risk of severe convective storms in the United States, including straight-line winds, tornadoes, hail and severe thunderstorms.

As evidenced by the March 31 severe storms responsible for more than 500 reports of tornadoes and hail from Texas to Ohio, data shows severe convective storm season peaks from March through June. These events are among the most frequent and damaging natural hazards in the country, causing the biggest weather-related property damage nationwide. As a result, it is also the most important time for insurance providers to assess their risk and implement measures to safeguard policyholders against future perils.

CoreLogic’s risk models estimate severe convective storms account for an average annual loss of more than $17 billion among the insured, with hail damage accounting for more than $11 billion of those losses. In 2022, 11 severe convective storm events caused losses that equaled more than $1 billion.

“The atmospheric changes that bring on severe storms produce events that are geographically large with irregular shapes,” said Tom Larsen, senior director of Insurance Solutions at CoreLogic. “Accurate risk assessment to inform preparation is critical for insurance companies and communities alike as severe weather events increase in severity and frequency with climate change.”

Metro Area and State Implications

Using its real-time Weather Verification technology and monitoring, CoreLogic examined the states that sustained the greatest amount of damage within the U.S. in 2022:

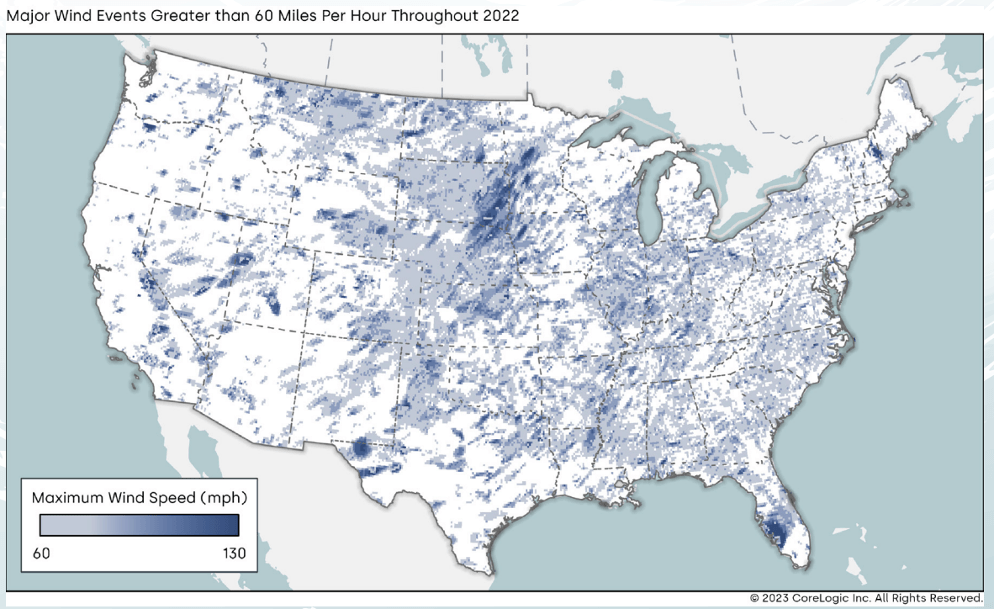

- Extreme winds in excess of 80 mph associated with severe convective storm activity affected more than half a million homes in 2022 with Texas, South Carolina, California, South Dakota and Indiana among the top five.

- In 2022, more than a million homes in the U.S. were damaged by hailstorms, with Texas, Minnesota, Arkansas, Nebraska and Iowa being the hardest-hit states.

- Almost 8,000 homes across the U.S. were affected by tornado damage in 2022, with approximately 233 homes immediately impacted by the wind spiral of the tornado, with the remaining homes damaged from peripheral effects, primarily flying debris. Texas, Ohio, Florida, Iowa and Mississippi were the five states that sustained the most damage.

Note – the total number and map above includes extreme winds associated with hurricane activity. In Florida alone, 728,485 homes were impacted by winds greater than 80 mph, mostly attributed to Hurricane Ian.

To establish storm resilient communities and for insurers to improve response time and quickly repair damage from these events, CoreLogic has developed a series of artificial intelligence (A.I.) and machine learning (ML) based digital tools and forensic information. These tools monitor storm activity and implement the best possible catastrophe response procedures for hazard-prone areas. Property insurers can evaluate areas with higher severe convective storm risk by using CoreLogic’s Weather Verification Services.

To learn more, visit: https://www.corelogic.com/insurance/hazard-risk-solutions/.

Methodology

This analysis begins with knowing where the properties in the U.S. are and the details of their construction. CoreLogic’s SpatialRecord databases cover more than 99.99% of all properties in the United States. Granular data at the property level enables better decision-making at the county, state and national level. Used in millions of insurance, real estate and banking transactions in the U.S., this data is the common currency in risk assessment for insurance and real estate.

This analysis is enabled by the WeatherVerification technology within CoreLogic’s Reactor platform. Running nightly, advanced algorithms are run on weather radar and other data feeds to develop precise maps representing the peak intensity of each peril (i.e., hail stones, tornado winds, straight-line winds). These maps are geo-referenced to CoreLogic property data to develop a daily register of damaged homes. Aggregated over the 365 days in 2022 produces the cumulative number of homes damaged within the U.S.

CoreLogic risk scores are developed from a long-term history of granular Weather Verification risk quantification combined with meteorological conforming smoothing to account for regions with insufficient observation history. For individual properties, they represent the most comprehensive method to asses the risk of damage from severe storm effects.

To estimate the value of property exposure to single-family residences, CoreLogic uses its RCV methodology which estimates the cost to rebuild in the event of a total loss and is not to be confused with property market value or new construction cost estimation. Reconstruction cost estimates more accurately reflect the actual cost of damage or destruction repair of residential buildings that would occur from the incidence of destructive hail, extreme winds or the wind-borne debris in severe convective storm events because they include the cost of materials, equipment and labor needed to rebuild. These estimates also factor in geographical differences in pricing of labor and materials (actual land values are not included in the estimate). The values in the report based on 100% (or “total”) destruction of the residential structure. Depending on the level of damage the repair costs may not produce a repair cost of 100% to the residence.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data contact Robin Wachner at newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

Media Contact

Robin Wachner

CoreLogic

newsmedia@corelogic.com