LightStream survey finds Americans are prioritizing personal style when it comes to home renovations

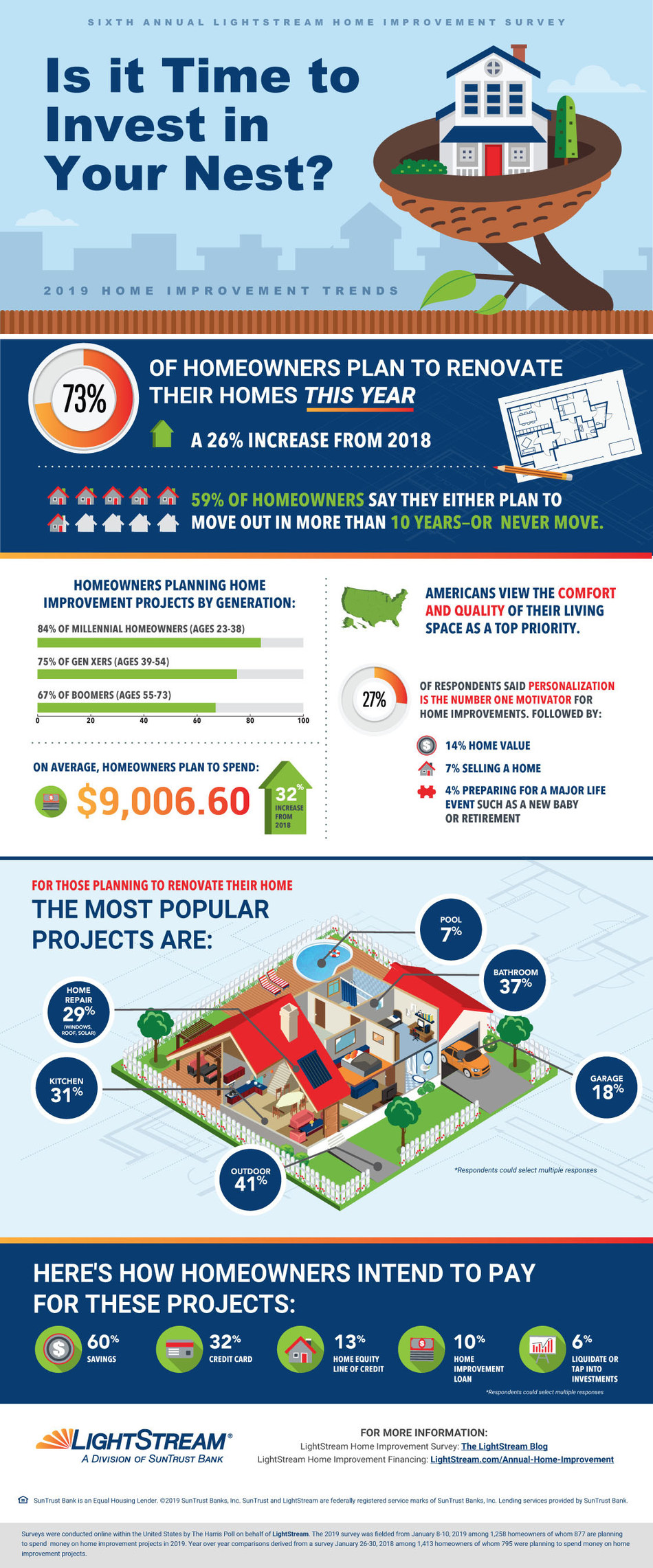

ATLANTA, March 5, 2019 /PRNewswire/ — Nearly three in four (73%) homeowners surveyed plan to make home improvements this year, a 26% increase from 2018, according to the sixth annual LightStream Home Improvement Survey conducted by The Harris Poll.

Homeowners also plan to spend more on those renovations – an average of about $9,000, the highest amount since the survey began in 2014. In addition, more homeowners this year will take on projects with major price tags. Those planning to spend $25,000 or more on improving their homes grew by 83% compared to last year.

In terms of what’s driving these renovations, Americans are more focused on creating a space they love than increasing the value of their home as an asset. Personalization is the number one motivator for investing in a home renovation (27%), ahead of increasing home value (14%); improving a home for sale (7%); or preparing for a major life event (4%) such as a new baby or retirement.

“The majority of homeowners are planning on staying in their homes for at least 10 years—or never move,” said Todd Nelson, senior vice president of strategic partnerships at LightStream. “Regardless of their age, we found that most consumers are focusing their home improvement projects to reflect their personal lifestyle, comfort and interests.”

As Americans prepare to tackle home improvement projects, lack of education and preparedness can often lead to unnecessary stress.

“Financial stress can impact the renovation process,” Nelson said. “By budgeting and educating themselves up front, homeowners can reduce strain, save money and manage an important project with confidence.”

LightStream offers three tips to help consumers take on a home improvement project with financial confidence:

- Build the Budget: The first step is to price out the bigger expenses, like materials and labor, then move on to inventory everything you will need to complete your project, down to paint brushes and tape. Make sure to leave room in your budget for unexpected expenses.

- Drill Down on DIY or Contractor: If you are willing to get your hands dirty, simple DIY-friendly efforts such as painting, demolition and landscaping will save money if you take them on yourself. Projects that include heavy construction, plumbing or electrical work may be best done by licensed professionals, who can save you from headaches in the long run.

- Choose the Right Funding: The majority of people taking on home improvement projects this year are planning to tap into their savings (60%), followed by credit cards (32%) and a home improvement loan (10%). While using a portion of savings can be a smart solution, it is also important to consider other funding options before dipping into money set aside for the future, like emergency funds or 401Ks. When planning larger projects, consider a home improvement loan instead of paying with high-interest credit cards or draining your savings.

“Unsecured home improvement loans can provide immediate financial means, flexibility and low, fixed interest rates for any project,” said Nelson. “With home improvement financing rates as low as 6.89% APR for 85-144 months for people with good credit,1 a LightStream loan can be a great option to help fund your next project.”

More information about LightStream and the 2019 Home Improvement Survey can be found at LightStream.com. Additional insights on 2019 home improvement trends can also be found on The LightStream Blog.

About LightStream, a division of SunTrust Bank

LightStream is a national online lending division of SunTrust Bank, which is focused on enhancing the financial confidence of its clients. LightStream provides unsecured loans to good-credit customers for practically any purpose, including home improvements. Financing is available in all 50 states; people need not have a SunTrust account in order to apply. Through a simple online application process, funds can be provided with no fees, on the same day. Click here [www.lightstream.com/disclosures] for important disclosures, including a payment example as well as information on same day funding, LightStream’s Rate Beat Program and its $100 Loan Experience Guarantee.

About SunTrust Banks, Inc.

SunTrust Banks, Inc. (NYSE: STI) is a purpose-driven company dedicated to Lighting the Way to Financial Well-Being for the people, businesses, and communities it serves. SunTrust leads onUp, a national movement inspiring Americans to build financial confidence. Headquartered in Atlanta, the Company has two business segments: Consumer and Wholesale. Its flagship subsidiary, SunTrust Bank, operates an extensive branch and ATM network throughout the high-growth Southeast and Mid-Atlantic states, along with 24-hour digital access. Certain business lines serve consumer, commercial, corporate, and institutional clients nationally. As of December 31, 2018, SunTrust had total assets of $216 billion and total deposits of $163 billion. The Company provides deposit, credit, trust, investment, mortgage, asset management, securities brokerage, and capital market services. Learn more at suntrust.com.

Survey Methodology

Surveys were conducted online within the United States by The Harris Poll on behalf of LightStream. The 2019 survey was fielded from January 8-10, 2019 among 1,258 homeowners, of whom 877 are planning to spend money on home improvement projects in 2019. Year over year comparisons derived from a survey January 26-30, 2018, among 1,413 homeowners, of whom 795 were planning to spend money on home improvement projects. These online surveys are not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodologies, including weighting variables and subgroup sample sizes, contact MediaRelations@lightstream.com.

1Your loan terms, including APR, may differ based on loan purpose, amount, term length, and your credit profile. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding. Rates without AutoPay are 0.50% higher. If your application is approved, your credit profile will determine whether your loan will be unsecured or secured. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice.

Payment example: Monthly payments for a $25,000 loan at 6.89% APR with a term of 12 years would result in 144 monthly payments of $255.63.

Maximum APR for a LightStream loan is 17.49%.

SOURCE LightStream, a division of SunTrust Bank